We’ve had a tumultuous summer and early fall. It was a savage Hurricane season this year with Harvey, Irma, Jose and Maria making landfall and devastating Texas, Louisiana, Florida, the eastern Caribbean and Puerto Rico. There were terrible forest fires in interior British Columbia and a severe earthquake in Mexico City. October saw the horrible mass shooting in Las Vegas and now the massive wildfires in California wine country that have razed whole communities. Our hearts go out to the victims of these tragedies.

Politics have not been much better. President Trump has been tweeting threats of military action and “fire and fury” at “Little Rocket Man”, the physically small but unfortunately nuclear-armed dictator Kim Jong-un of North Korea. The influential Republican Senator Bob Corker suggested that Trump’s incendiary tweets could be sending the United States towards World War III. This then started a very public Twitter war between the President and a very senior member of his own party, which included Corker’s scathing comment that the White House is an “Adult Day Care”. After being stymied in Congress with his “Make America Great Again” agenda, Trump has also been very publicly feuding with other members of his own Republican Party and even his Cabinet. The NAFTA trade agreement now looks like it could be terminated by the Trump administration, along with subsidies to ObamaCare and the Iran nuclear deal. The motto of the Trump administration now seems to be “if you can’t fix it, break it”.

Plummeting Popularity and Rockets

Things across the Atlantic are not much better. The reality of governing has seen plummeting popularity for President Emmanuel Macron of France. European voters continue to be angry with their politicians and are forcefully expressing it at the polls. Britain is still stumbling into a Brexit disaster after an ill-timed and disastrous election call with a very weakened Prime Minister Theresa May at the helm. Her Conservative Party ship is sinking under the weight of its own internal strife with the vehemently socialist Jeremy Corbin and his Labour Party waiting in the wings. The rest of Europe has taken a right turn. Austria has just given an electoral victory to the young Sebastian Kurz and his right-wing People’s Party. Even stolid Germany now has the very right wing Afd Party elected to the Bundestag for the first time, which complicates Angela Merkel’s governing coalition and weakens her governing ability.

Things across the Pacific are no better. Asia fears the collateral damage of the escalating dispute between the U.S. and the North Koreans. Rockets are literally flying over Japan and Xi’s China is frozen in a catatonic state of denial. With allies like Kim Jong-un, who needs enemies?

Good Economic News

You can be forgiven for being more than a little dispirited from all this negative news. It truly seems that things are bad until you look at the global economies. Yes, there actually is good news on the economic front. A steady drip of reasonable if not good economic news gets lost in the blaring Twitter and real storms of the day but it continues to add up to a fairly healthy U.S. economy. Canada, despite its world beating consumer debt levels, is also doing fine at the moment. The global economic recovery continues to broaden and chug along without a lot of drama. Even Europe, despite its propensity towards political hari-kari, has the ECB admitting to a reasonable economic picture.

You are now wondering why you haven’t heard about all this good economic news. It has to do with the media and political focus on negative news. Forget “Fake News”, the financial media loves a terrible story or “Crappy News”. The world sailing off the edge of the known financial system makes for a far more engaging story than slowly chunking out good financial statistics.

Super Wrong Heroes

We also think it has to do with the “super-hero” central banker persona. It’s hard to ask Iron Man or Batman to hang up their suits and retire from saving the world from Evil Doer carnage. The same goes for the current crop of renowned financial crisis fighters at the world’s central banks. Get things back to economic and financial normalcy and your dreary desk awaits. Who wants to go back to being a boring financial bureaucrat when you’re used to strutting the world stage with people hanging on your every word and gesture?

Central bankers have been questioning the durability of the recovery from the Great Recession for almost 10 years now and it has made them very popular with the financial paparazzi. Perhaps we can chalk it up to post-traumatic stress from the Credit and the Euro Debt crises but certainly our exalted financial leaders have been super wrong. Their extraordinary fears have been translated in their continuation of “extraordinary monetary policy” that is only now starting to be reversed.

The Trump Card

Investment strategists and economists are also only now recognizing the improving economic prospects but Mr. Market has already voted them off the island. Investors have pushed stock prices to new highs and bond yields are also making recent new highs. We won’t talk too much about stocks. It is suffice to say that we still think they are far better value than very expensive bonds. The stock market is doing well and we direct you for confirmation to no less a market strategist than @realDonaldTrump:

@realCanso???

With all due respect to President Trump, he has been very late to the game to claim personal credit for the economic and market resurgence that predates his administration by many years. We have been telling you about this for a very long time but we must admit that Trump’s Twitter habits have caught our attention. We are very envious. Writing only 140 characters would certainly make our job much easier. After 20 years of prognosticating in the Market Observer, we are ready to join the Twitter fray. We can see it now,

@realCanso:

“Bond Yields hit NEW HIGHS!

Corporate bonds OUTPERFORM!

Floating rate notes FOREVER.”

Well maybe not!! Calm down Compliance, we were only kidding…

Up With Yields, Down With Bonds!!

The economic recovery is a good news, bad news story for financial markets. Stock prices are up but bond yields are up as well. Higher yields mean that bond prices are substantially down. This should not come as a surprise to the loyal readers of the Canso Market Observer. We have been telling you for some time that bond yields were going up which was not that popular a view. Remember the financial media fascination with “negative yields” in early 2016? This was definitely popular as a financial bad news story but we told you that it defied financial reality.

Archaic Thoughts

We tell our young staff, some of the brightest financial minds we have met and whom we have the honour to teach, that a large part of their training at Canso is to insulate themselves from the consensus and to look at the underlying fundamentals. This is easier said than done. We must admit to having felt a bit old fashioned, if not archaic, at explaining to them why buying 10 or 30-year bonds at yields less than the prevailing inflation rate and probably well less than future inflation was not that bright an idea. The financial media was replete at the time with talking heads explaining negative yields as a result of everything from the digital revolution to alien invasion. Okay, we admit that alien invasion is a bit of embellishment.

“Trying to Forget my Feelings of Yield”

You are probably thinking that all this talk of higher yields is a little overdone. It still feels to you like yields are very low and our fixation with higher yields is more than a little obsessive. The problem is like the one described in Driver Education courses to generations of young drivers. When you get used to travelling at high speed on the highway, you must be aware that you have been “velocitized” and will find it hard to slow down. You are now “yielditized” to low yields and find it hard to contemplate higher yields.

Stealing a technique from the Canso Corporate Bond Letter to emphasize this point, the Market Observer editorial team refers you to the lyrics of the 1970s song “Feelings”, sung by Morris Albert. It was written by the songwriting team of Barry Mann and Cynthia Weil who were featured prominently in Beautiful, The Carole King Musical, which we highly recommend. If you are currently wondering if, as you always have suspected, we have finally lost it at Canso, bear with us a little. Our apologies to Mr. Mann and Ms. Weil, but if we selectively replace the words “love” and “girl” with “yield” and “low yields” you should get our drift:

Feelings,

by Mann and Weil

(Bond market rewrite by Anonymous)

“Feelings, nothing more than feelings,

Trying to forget my feelings of yield (love).

Teardrops rolling down on my face,

Trying to forget my feelings of yield (love).

Feelings, for all my life I’ll feel it.

I wish I’ve never met you, low yields (girl); you’ll never come again.”

Okay, after this rather elaborate editorial device, you realize we are saying that it is almost impossible for an economist, market strategist, bond investor, bond trader or even a random person walking down the street who has experienced nothing but generally falling interest rates to envision anything else.

Graphic Data

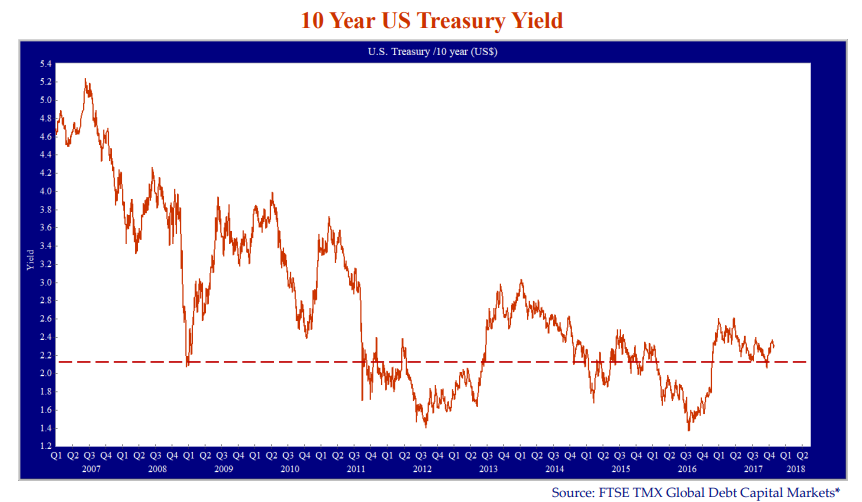

We tell our research analysts and portfolio managers that they should always graph the data and have a look to see if it makes sense. This has been an invaluable tool at Canso to keep us grounded in financial reality. We have provided you with the chart of the 10 Year U.S. Treasury yield (solid red line) bellow. As you can see from the dashed line in the chart, yields on the 10 year UST Bond are up considerably in the last year and actually back to the levels of 2011, just before the Euro Debt Crisis, and above the lows of the Credit Crisis in 2008. You can also observe that we have a ways to go to get “back to normal” in terms of bond yields. Bond yields from 2009 to 2011 averaged from the current 2.4% to up to 4.0%, and at the time US inflation was close to current levels.

Historically Ignorant

Yes, this is only taking us back to the Credit Crisis, relatively ancient history for today’s current crop of young bond market participants. We will once again give you some historical perspective, which we believe is very important to any discussion of “normalized” interest rates. The quest to make economics and finance into a “hard quantitative science” has in fact made them a study in the absurdity of assuming away human experience and foibles. It amazes us that economists and investment strategists fall back on the interest rate and inflation regimes that they have personally experienced rather than research what has happened over the broad sweep of financial history.

GrandPa’s Interest Rates

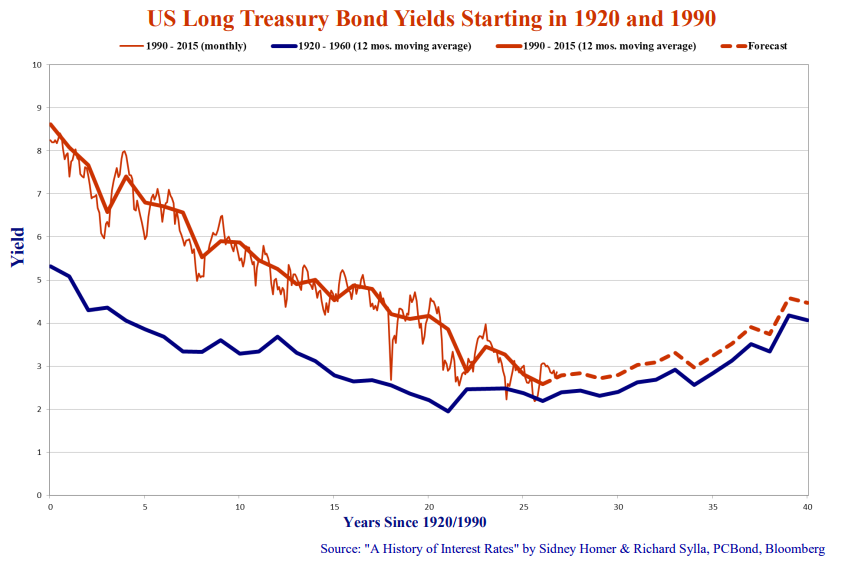

We reintroduce you to our long-term historical chart bellow, comparing our recent interest rate history since 1990 to the 40-year period from 1920 to 1960. We’ve covered our rationale for choosing these two time periods in prior editions of the Market Observer so it’s suffice to say the recent move up in yields continues to trace our grandfather’s interest rate experience. Yes, things were tough economically in the Great Recession in the U.S. after the Credit Crisis of 2008 and the subsequent real estate meltdown but they were nowhere near the harsh economic and social conditions of the Great Depression of the 1930s.

We find the parallels fascinating. We are 27 years into the cycle in 2017, which matches 1947 in the earlier cycle. Note that the thick blue line, the 12-month moving average of the long-term Treasury bond yield from 1920 to 1960 bottomed in the 21st year, which was 1941. The long-term T-Bond then bounced around but had definitely started an upward yield path at this point.

Follow the Bouncing Yield Ball

Our current cycle seems to show the 12-month moving average since 1990 (thick red line) is bottoming in similar fashion. The monthly T-Bond yield from 1990 (thin red line) seems to be bouncing off the 1920-1960 moving average (thick blue line), which we find interesting. To give you a sense of what might be ahead, we have taken the current differential between the two period long T-Bond moving average lines and plotted a forecast red dashed line that starts at present in 2017. If this were accurate, we would expect to see a gentle move upwards in the long T-Bond yield and further interest rate “normalization”.

Bond Prices Can Fall

We want to emphasize that higher yields do not result in higher bond prices to the holders of existing bonds. Higher bond yields means that bond prices fall. No, we are not being condescending. The relationship between bond yields and prices is inverse, counterintuitive and confuses many people, including investment professionals. We have learned to explain this relationship simply over our many years in the bond markets.

We’ll use the example of a person who bought the 10-year 1% Canada bond issued in July 2016. Our mystery buyer bought this security for $97.99, at a $2.01 discount to its par value of $100 since the 10-year Canada bond yield at the time was a little bit higher at 1.2%. She gave the Canadian government her $97.99 in exchange for their promise to pay her a coupon of 1% or $1 (actually $.50 every 6 months) in interest for the next 10 years and $100 at maturity on June 1st, 2027.

Bond Price Check

Let’s assume she wants to sell it now, in October 2017. Today’s interest rates for 10-year Canada bonds are now much higher at just over 2.0%. What would you pay her for her 1% Canada bond if new ones pay 2% or $2 per bond? Clearly it would be less, but the size of the price decline might surprise you. A way to think about this is that you as the new holder would be out $1 for the next 9 years or $9 in total compared to buying a new 2% bond so you could offer her $91. In fact, the actual price today on October 16th is $91.13 so you really don’t need a bond calculator to figure things out.

Yes, the investors who were piling into this “safe” bond last year have now lost 7%, offset by $1 in coupon interest so they are down about 6%. The bond market works the same way. We think this will come as a surprise to many people who are invested in bond mutual funds and “cheap and liquid” ETFs. Interest rate sensitivity or duration increases with longer term and lower yields. This means that today’s bond market is a much more dangerous place and has a lot more downside than in years gone by. The duration of the FTSE TMX Canada Bond Universe Index is 7.3 years, which means that it goes up and down 7.3% for every 1% change in yield. That is why the Universe Index is -3% for the 12-month period ending September 30th, 2017.

Accentuate the Negatives

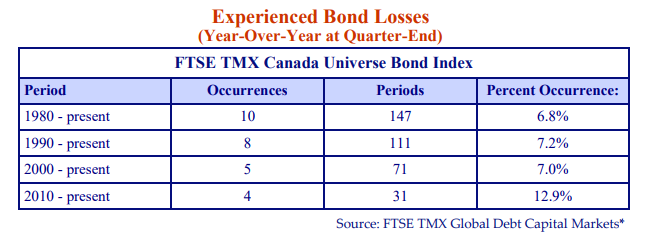

There have not been that many periods of negative returns in the Canadian bond market since interest rates and bond yields peaked in 1981. We have taken a look and show the historical results in the table below. There have only been negative returns 6.8% of the time, or (10 times out of the 147 periods), on a year-over-year basis at a quarter end since 1980. Only 7.2% of the periods since 1990 and 7.0% of the periods since 2000 have been negative, in line with the longer period from 1980. There are more negative periods, 12.9% of the time (4 periods out of 31), over the shorter period since 2010. This makes sense, as longer durations create larger capital losses and there is much lower yield to offset these.

How Bad Can It Get??

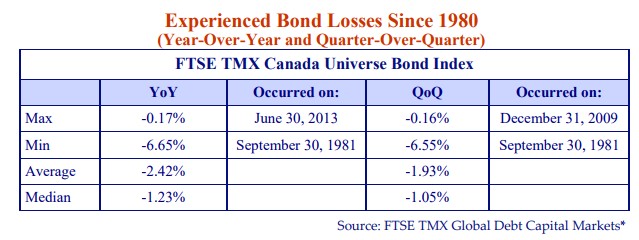

How bad can it get? The table below shows the magnitude of the Canadian bond market setbacks since 1980. On average, a losing year-over-year period has seen an average loss of -2.4% loss with an average quarter-over-quarter loss of -1.9%.

The quarter ended September 30th, 1981, which saw the peak yield on the Universe Index of 19.1%, saw a year-over-year decline of -6.7% on the Bond Universe Index. The quarter-over-quarter loss of -6.6% was almost the same. You might have expected a more severe outcome for the longer period, but counter intuitively, the high yield over the prior year offset much of the capital loss. The yield on the Universe at September 30th, 1980 was 13.4% and rose 5.7% to 19.1% a year later at September 30th, 1981. Using an average yield over the year of 16.2% and the experienced return of -6.6%, we can approximate the capital loss at -22.8%!

You might argue that another increase of 5.7% in the Universe yield is unlikely to occur. On the other hand, the duration of the Universe in 1981, with much higher coupons and much shorter bond terms, was only 4.0 years. With today’s Universe duration of 7.3 years and a yield of 2.5%, it would only take a 1.2% increase in the Universe yield for an equal loss of 6.6% over the next year.

Safe and Sorry!

We’ve also been telling you with some trepidation that year-over-year bond mutual fund returns were about to go very negative. The retail investor in his “safe” bond fund is in for a shock when he gets his quarterly statements. According to GlobeInvestor, the average mutual fund was down -2.7% for the 12 months ended Sep 30th, 2017. The “low fee and liquid” iShares Universe ETF saw a much lower -3.2% return which lagged the actual Bond Universe return of -2.9% due to its management expenses of .3%. What! Active bond mutual funds actually beat their passive ETF equivalent despite all the ETF hype and propaganda? Go figure. This most likely results from an overweight in corporate bonds as the Corporate Bond Index was only down -.4% in the period and/or possibly a shorter portfolio term.

New and Hypoxic Highs

Yes, things are not great in Fixed Income Land and we think they might even get worse, both from rising yields and falling credit quality. Our readers know that we think the next financial crisis will result from the current speculation in the bank loan and high yield markets. This credit cycle has been particularly volatile with high yield dropping double digits in early 2016 and then soaring to new and hypoxic highs by the summer of 2016. The lesson for new mutual fund managers was to never be in cash to avoid the dreaded underperformance disease that inevitably results in unemployment. Certainly there is some relative performance comfort in knowing that all your high yield peers will have their funds cratering the same time as you but it’s not great from their client’s point of view.

No Idea of the Downside

What troubles us the most is a new and rather perverse expression of financial intermediation, brought about by all the easy money from “extraordinary” monetary policy. This sees predatory private equity managers being funded by high yield and leveraged bank loan mutual funds and ETFs. These cater to naïve retail investors stretching for yield who have no idea of the downside they are signing up for.

When the money flows into the funds, the portfolio managers rush to “get invested” and buy whatever crap the underwriters have to offer. The underwriters compete among themselves to offer the best terms and lowest interest rates to the issuers. In a shameless effort to curry favour with the private equity managers and maximize fees, protections for the lenders disappear and coupons are lowered to absurd levels. We think that when the speculative tide goes out and the investor flows turn negative it’s going to be “Look Out Below” for prices. Since we have belaboured this viewpoint for some time, we won’t bother you with another litany of credit excesses. We will, however, turn to an outside expert but not @realDonaldTrump.

Two Sides to Every Trade

Our attention was caught by a Bloomberg story on Michael Milken, Michael Milken Says Private Equity’s ‘Golden Age’ Will Continue (Steve Dickson, Bloomberg.com, September 14, 2017). In our view, Milken was the founder of the modern high yield market in the 1980s at Drexel Burnham Lambert. We remember reading an article on Milken in the 1980s that said he spent a lot of time reading trust indentures, something we believe in, of obscure “junk bond” issues that nobody wanted at the time. He really does know what he’s talking about. Milken now believes that this is a great time for private equity but the implication is that it is a terrible time for high yield bonds and bank loans:

“ ‘This is their (private equity) golden age,” Milken, who helped pioneer the junk bond market at Drexel Burnham Lambert Inc., said Thursday…’You can leverage, you can borrow without covenants, and so for equity holders it affords you very unusual rates of return…”Milken, who now runs his own research firm and focuses on philanthropy, said the decline of maintenance covenants, which help protect lenders from adverse credit events, is a key driver in the growth of private equity…For bond investors ‘today the yields are extremely low, and so therefore you’re not really getting paid much of a premium to invest, but even more important is that the covenants are gone.’ ”

Milken’s comments should not come as a surprise to our loyal readers and clients. There are two sides to every trade in the financial markets. Milken’s strong recommendation of private equity is really saying that the lenders are on the losing side of this trade. The other side of the “very unusual (high) rates of returns” for equity holders is that lenders will get unusually low rates of returns for the risks they are taking. The danger of weakened covenants and poor credit structures is something we have been harping on for some time but it is nice to see someone else commenting on the subject.

Well, that’s about all we have to say at this time on the markets.

Thanks To Our Clients!

As many of you know, we at Canso are celebrating the 20th Anniversary of our first investment mandates being funded in October 1997. We were a credit manager before there really was such a thing. When we said we wanted to just invest in corporate bonds and practice security selection, people would give us strange looks and seek any excuse to switch the topic to something investment sexy like “Asset Mix”. Some even walked away. Others would say “why do credit analysis when you can just use credit ratings”. Well, we think we won that argument!

We are most proud of what we have been able to do for our clients over the past 20 years. When we started our initial Investment Grade mandate, we predicted we would add 50 bps or .5% over our Corporate Bond Index benchmark and we thought it would be very difficult. We are very pleased that the 20-year compounded return for this account is 7.0%, a value-added of 1.2% above the FTSE TMX Canada All Corporate Index return of 5.8%.

We predicted 1.0% value-added for our initial Broad Corporate Bond mandate, since we could invest in up to 30% below investment grade at our discretion. We are happy to report that this account has returned 8.0%, value-added of 2.2% over the FTSE TMX All Corporate Index return of 5.8%. It has also outperformed the FTSE TMX Canada High Yield Index return of 7.4%, which is composed entirely of below-investment grade bonds, by .6%.

Our investment thesis that separating out the corporate bonds from the overall Universe “core” portfolio and measuring it against a corporate bond benchmark has certainly proven itself over the years. The overall FTSE TMX Canada Universe, composed of Canada, Provincial, Municipal and Corporate Bonds has returned 5.4% over the 20 years since we started. With our Investment Grade and Broad Corporate mandates returning 7.0% and 8.0% respectively, that’s a lot of value-added compared to a conventional “core” portfolio.

We profoundly thank all of our clients for the trust you have placed in us when you chose us to manage your portfolios.

Happy Anniversary!